Duckhorn Portfolio Inc

NYSE:NAPA

| US |

|

Johnson & Johnson

NYSE:JNJ

|

Pharmaceuticals

|

| US |

|

Berkshire Hathaway Inc

NYSE:BRK.A

|

Financial Services

|

| US |

|

Bank of America Corp

NYSE:BAC

|

Banking

|

| US |

|

Mastercard Inc

NYSE:MA

|

Technology

|

| US |

|

UnitedHealth Group Inc

NYSE:UNH

|

Health Care

|

| US |

|

Exxon Mobil Corp

NYSE:XOM

|

Energy

|

| US |

|

Pfizer Inc

NYSE:PFE

|

Pharmaceuticals

|

| US |

|

Palantir Technologies Inc

NYSE:PLTR

|

Technology

|

| US |

|

Nike Inc

NYSE:NKE

|

Textiles, Apparel & Luxury Goods

|

| US |

|

Visa Inc

NYSE:V

|

Technology

|

| CN |

|

Alibaba Group Holding Ltd

NYSE:BABA

|

Retail

|

| US |

|

3M Co

NYSE:MMM

|

Industrial Conglomerates

|

| US |

|

JPMorgan Chase & Co

NYSE:JPM

|

Banking

|

| US |

|

Coca-Cola Co

NYSE:KO

|

Beverages

|

| US |

|

Walmart Inc

NYSE:WMT

|

Retail

|

| US |

|

Verizon Communications Inc

NYSE:VZ

|

Telecommunication

|

Utilize notes to systematically review your investment decisions. By reflecting on past outcomes, you can discern effective strategies and identify those that underperformed. This continuous feedback loop enables you to adapt and refine your approach, optimizing for future success.

Each note serves as a learning point, offering insights into your decision-making processes. Over time, you'll accumulate a personalized database of knowledge, enhancing your ability to make informed decisions quickly and effectively.

With a comprehensive record of your investment history at your fingertips, you can compare current opportunities against past experiences. This not only bolsters your confidence but also ensures that each decision is grounded in a well-documented rationale.

Do you really want to delete this note?

This action cannot be undone.

| 52 Week Range |

5.4

11.11

|

| Price Target |

|

We'll email you a reminder when the closing price reaches USD.

Choose the stock you wish to monitor with a price alert.

|

Johnson & Johnson

NYSE:JNJ

|

US |

|

Berkshire Hathaway Inc

NYSE:BRK.A

|

US |

|

Bank of America Corp

NYSE:BAC

|

US |

|

Mastercard Inc

NYSE:MA

|

US |

|

UnitedHealth Group Inc

NYSE:UNH

|

US |

|

Exxon Mobil Corp

NYSE:XOM

|

US |

|

Pfizer Inc

NYSE:PFE

|

US |

|

Palantir Technologies Inc

NYSE:PLTR

|

US |

|

Nike Inc

NYSE:NKE

|

US |

|

Visa Inc

NYSE:V

|

US |

|

Alibaba Group Holding Ltd

NYSE:BABA

|

CN |

|

3M Co

NYSE:MMM

|

US |

|

JPMorgan Chase & Co

NYSE:JPM

|

US |

|

Coca-Cola Co

NYSE:KO

|

US |

|

Walmart Inc

NYSE:WMT

|

US |

|

Verizon Communications Inc

NYSE:VZ

|

US |

This alert will be permanently deleted.

Duckhorn Portfolio Inc

Duckhorn Portfolio Inc

Duckhorn Portfolio Inc

PP&E Net

Duckhorn Portfolio Inc

PP&E Net

Duckhorn Portfolio Inc

PP&E Net Peer Comparison

Competitors Analysis

Latest Figures & CAGR of Competitors

| Company | PP&E Net | CAGR 3Y | CAGR 5Y | CAGR 10Y | ||

|---|---|---|---|---|---|---|

|

Duckhorn Portfolio Inc

NYSE:NAPA

|

PP&E Net

$595.6m

|

CAGR 3-Years

35%

|

CAGR 5-Years

20%

|

CAGR 10-Years

N/A

|

|

|

Brown-Forman Corp

NYSE:BF.B

|

PP&E Net

$1.1B

|

CAGR 3-Years

9%

|

CAGR 5-Years

4%

|

CAGR 10-Years

7%

|

|

|

Constellation Brands Inc

NYSE:STZ

|

PP&E Net

$7.9B

|

CAGR 3-Years

13%

|

CAGR 5-Years

7%

|

CAGR 10-Years

13%

|

|

|

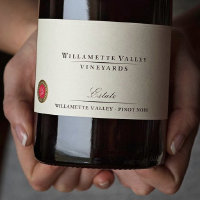

Willamette Valley Vineyards Inc

NASDAQ:WVVI

|

PP&E Net

$63.6m

|

CAGR 3-Years

15%

|

CAGR 5-Years

14%

|

CAGR 10-Years

16%

|

|

|

MGP Ingredients Inc

NASDAQ:MGPI

|

PP&E Net

$307.1m

|

CAGR 3-Years

14%

|

CAGR 5-Years

19%

|

CAGR 10-Years

17%

|

|

|

Crimson Wine Group Ltd

OTC:CWGL

|

PP&E Net

$115.4m

|

CAGR 3-Years

1%

|

CAGR 5-Years

-1%

|

CAGR 10-Years

1%

|

|

Duckhorn Portfolio Inc

Glance View

Nestled in the heart of California's Napa Valley, Duckhorn Portfolio Inc. is a compelling narrative in the world of luxury wine production. Founded in 1976 by Dan and Margaret Duckhorn, the company has grown into a preeminent multi-brand wine company, renowned for crafting high-quality, luxury wines. Its journey from a single vineyard vision to a distinguished family of wineries reflects a deep-seated commitment to excellence in viticulture and winemaking. This growth rests on a foundational strategy of acquiring and developing premium vineyards across California and Washington State, regions known for their rich soils and optimal climates, ideal for producing distinctive wines. Through a portfolio that spans Duckhorn Vineyards, Decoy, Goldeneye, Paraduxx, Calera, Kosta Browne, and Canvasback, the company is able to cater to diverse palates, offering a range from delicate Pinot Noirs to bold Bordeaux varietals. Duckhorn's business model is meticulously crafted, capitalizing on both direct-to-consumer sales and a vast distribution network reaching wholesale channels. This dual approach allows them to capture premium pricing for their products while ensuring vast market reach. Beyond just selling a bottle, Duckhorn emphasizes the cultivation of brand loyalty and craftsmanship reputation, integral to how luxury wine commands substantial margins. The company's marketing revolves around wine clubs, exclusive tasting rooms, and savvy digital platforms that enhance consumer engagement and direct sales channels. This approach not only sustains but amplifies their economic resilience, navigating the dynamics of both domestic and international markets, while consistently expanding their influence in the global wine industry.

See Also

What is Duckhorn Portfolio Inc's PP&E Net?

PP&E Net

595.6m

USD

Based on the financial report for Jul 31, 2024, Duckhorn Portfolio Inc's PP&E Net amounts to 595.6m USD.

What is Duckhorn Portfolio Inc's PP&E Net growth rate?

PP&E Net CAGR 5Y

20%

Over the last year, the PP&E Net growth was 73%. The average annual PP&E Net growth rates for Duckhorn Portfolio Inc have been 35% over the past three years , 20% over the past five years .

You don't have any saved screeners yet

You don't have any saved screeners yet