Oatly Group AB

NASDAQ:OTLY

Income Statement

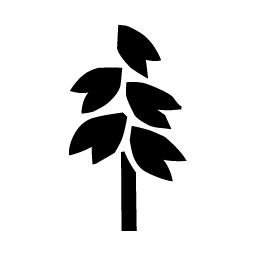

Earnings Waterfall

Oatly Group AB

|

Revenue

|

823.7m

USD

|

|

Cost of Revenue

|

-584.1m

USD

|

|

Gross Profit

|

239.6m

USD

|

|

Operating Expenses

|

-353.8m

USD

|

|

Operating Income

|

-114.2m

USD

|

|

Other Expenses

|

-87.7m

USD

|

|

Net Income

|

-201.9m

USD

|

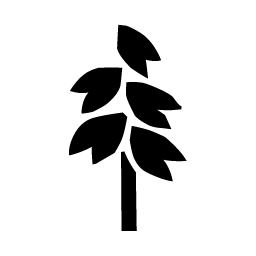

Income Statement

Oatly Group AB

| Dec-2020 | Mar-2021 | Jun-2021 | Sep-2021 | Dec-2021 | Mar-2022 | Jun-2022 | Sep-2022 | Dec-2022 | Mar-2023 | Jun-2023 | Sep-2023 | Dec-2023 | Mar-2024 | Jun-2024 | Sep-2024 | Dec-2024 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | ||||||||||||||||||

| Revenue |

421

N/A

|

477

+13%

|

528

+11%

|

585

+11%

|

643

+10%

|

669

+4%

|

701

+5%

|

713

+2%

|

722

+1%

|

752

+4%

|

770

+2%

|

774

+1%

|

783

+1%

|

787

+0%

|

793

+1%

|

813

+3%

|

824

+1%

|

|

| Gross Profit | ||||||||||||||||||

| Cost of Revenue |

(292)

|

(333)

|

(375)

|

(422)

|

(485)

|

(535)

|

(575)

|

(617)

|

(613)

|

(623)

|

(630)

|

(611)

|

(614)

|

(618)

|

(607)

|

(604)

|

(584)

|

|

| Gross Profit |

129

N/A

|

144

+12%

|

153

+6%

|

162

+6%

|

159

-2%

|

134

-16%

|

126

-6%

|

96

-24%

|

109

+14%

|

129

+18%

|

140

+9%

|

163

+17%

|

169

+3%

|

169

0%

|

186

+10%

|

210

+13%

|

240

+14%

|

|

| Operating Income | ||||||||||||||||||

| Operating Expenses |

(178)

|

(215)

|

(266)

|

(311)

|

(365)

|

(403)

|

(419)

|

(439)

|

(433)

|

(474)

|

(484)

|

(475)

|

(395)

|

(586)

|

(568)

|

(559)

|

(354)

|

|

| Selling, General & Administrative |

(164)

|

(204)

|

(254)

|

(298)

|

(344)

|

(388)

|

(402)

|

(420)

|

(405)

|

(408)

|

(417)

|

(401)

|

(362)

|

(353)

|

(331)

|

(323)

|

(315)

|

|

| Research & Development |

(7)

|

(9)

|

(12)

|

(14)

|

(16)

|

(18)

|

(20)

|

(21)

|

(22)

|

(24)

|

(23)

|

(23)

|

(20)

|

(20)

|

(26)

|

(32)

|

(28)

|

|

| Depreciation & Amortization |

(4)

|

0

|

0

|

0

|

(7)

|

0

|

0

|

0

|

(9)

|

0

|

0

|

0

|

(13)

|

0

|

0

|

0

|

(11)

|

|

| Other Operating Expenses |

(4)

|

(2)

|

(1)

|

1

|

3

|

3

|

3

|

2

|

2

|

(42)

|

(44)

|

(51)

|

(1)

|

(212)

|

(212)

|

(204)

|

1

|

|

| Operating Income |

(49)

N/A

|

(70)

-43%

|

(114)

-62%

|

(149)

-31%

|

(206)

-38%

|

(269)

-31%

|

(293)

-9%

|

(343)

-17%

|

(324)

+6%

|

(345)

-7%

|

(345)

+0%

|

(311)

+10%

|

(226)

+27%

|

(417)

-84%

|

(382)

+8%

|

(349)

+9%

|

(114)

+67%

|

|

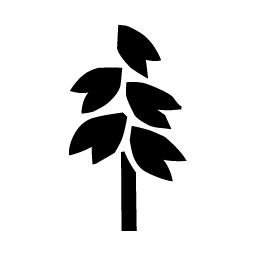

| Pre-Tax Income | ||||||||||||||||||

| Interest Income Expense |

(9)

|

(10)

|

(20)

|

(15)

|

(2)

|

5

|

15

|

3

|

(5)

|

(6)

|

1

|

122

|

65

|

58

|

62

|

(56)

|

(9)

|

|

| Non-Reccuring Items |

0

|

(1)

|

(1)

|

(2)

|

(7)

|

(9)

|

(11)

|

(21)

|

(68)

|

(30)

|

(32)

|

(28)

|

(228)

|

3

|

4

|

10

|

(70)

|

|

| Total Other Income |

(1)

|

(0)

|

(0)

|

(0)

|

(1)

|

(1)

|

(1)

|

(0)

|

(1)

|

(1)

|

(19)

|

(19)

|

(19)

|

(24)

|

(6)

|

(6)

|

(6)

|

|

| Pre-Tax Income |

(58)

N/A

|

(81)

-39%

|

(135)

-67%

|

(166)

-23%

|

(215)

-30%

|

(273)

-27%

|

(289)

-6%

|

(361)

-25%

|

(397)

-10%

|

(382)

+4%

|

(394)

-3%

|

(237)

+40%

|

(408)

-72%

|

(380)

+7%

|

(322)

+15%

|

(401)

-24%

|

(199)

+50%

|

|

| Net Income | ||||||||||||||||||

| Tax Provision |

(2)

|

(4)

|

(4)

|

(4)

|

3

|

6

|

9

|

13

|

5

|

2

|

(1)

|

(6)

|

(9)

|

(7)

|

(9)

|

(9)

|

(4)

|

|

| Income from Continuing Operations |

(60)

|

(85)

|

(139)

|

(170)

|

(212)

|

(268)

|

(281)

|

(347)

|

(393)

|

(381)

|

(395)

|

(243)

|

(417)

|

(387)

|

(331)

|

(410)

|

(202)

|

|

| Income to Minority Interest |

0

|

0

|

0

|

0

|

0

|

0

|

0

|

0

|

0

|

0

|

0

|

0

|

0

|

0

|

0

|

0

|

0

|

|

| Net Income (Common) |

(60)

N/A

|

(85)

-40%

|

(139)

-64%

|

(170)

-22%

|

(212)

-25%

|

(268)

-26%

|

(281)

-5%

|

(347)

-24%

|

(393)

-13%

|

(381)

+3%

|

(395)

-4%

|

(243)

+38%

|

(417)

-71%

|

(387)

+7%

|

(331)

+15%

|

(409)

-24%

|

(202)

+51%

|

|

| EPS (Diluted) |

-0.1

N/A

|

-0.14

-40%

|

-0.26

-86%

|

-0.29

-12%

|

-0.39

-34%

|

-0.46

-18%

|

-0.47

-2%

|

-0.58

-23%

|

-0.66

-14%

|

-0.64

+3%

|

-0.67

-5%

|

-0.24

+64%

|

-14.05

-5 754%

|

-0.65

+95%

|

-11.09

-1 606%

|

-13.69

-23%

|

-6.77

+51%

|

|

You don't have any saved screeners yet

You don't have any saved screeners yet