Tariffs Impact on US Semis

Tariffs on semiconductor imports could significantly increase production costs for U.S. manufacturers, as they rely on global supply chains for raw materials, equipment, and silicon wafers. This would make companies like Intel, AMD, and NVIDIA less competitive, potentially leading to market share losses to Asian rivals such as TSMC and Samsung. Higher costs might also encourage U.S. firms to shift production overseas, reducing domestic manufacturing and weakening the country’s semiconductor industry. Additionally, retaliatory tariffs from other nations could further disrupt supply chains and limit access to essential materials and technologies. In the long run, reduced investment in R&D and slower innovation could erode the U.S.'s technological leadership in the global semiconductor market.

Increased Production Costs

One of the most immediate effects of tariffs is the rising cost of semiconductor production. The global semiconductor supply chain is highly interconnected, with key components and materials heavily reliant on imports. For example:

- Rare earth metals and chemical reagents (such as gallium, indium, hafnium, and gallium arsenide) are often sourced from China, and tariffs on their import could drive up material costs.

- Lithography and etching equipment is manufactured by leading global companies such as ASML (Netherlands) and Tokyo Electron (Japan). Tariffs on these imports would make it more expensive to upgrade U.S. semiconductor plants.

- Silicon wafers, the fundamental building blocks of semiconductor production, are largely imported, and trade barriers could further increase expenses.

Rising costs for raw materials and equipment inevitably increase the overall production cost, making U.S. companies less competitive compared to foreign manufacturers who can procure the same components without additional tariff burdens.

Reduced Global Competitiveness

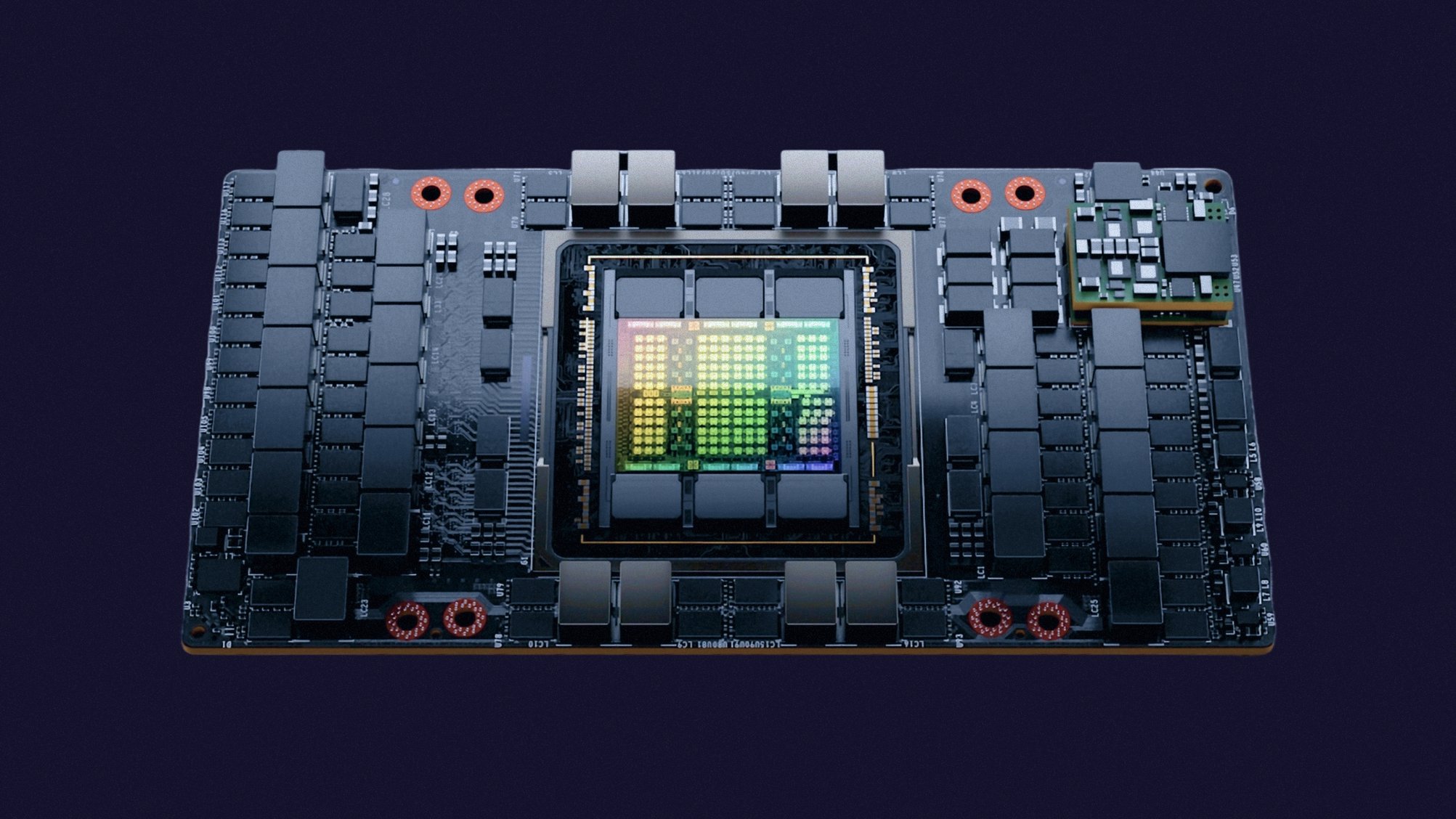

Many U.S. semiconductor manufacturers, such as Intel, AMD, NVIDIA, and Qualcomm, compete directly with Asian giants like TSMC, Samsung, and MediaTek, which may not face the same tariff restrictions. If tariffs increase the cost of production, the following consequences may arise:

- Customers (including electronics and automotive manufacturers) may shift to Asian suppliers due to lower prices.

- Companies like TSMC and Samsung can continue exporting chips to the U.S. without major cost increases, maintaining their competitive edge.

- American firms may lose market share in global markets, especially if other countries introduce retaliatory tariffs on U.S. semiconductor products.

In the long run, reduced competitiveness could slow down the growth of the U.S. semiconductor industry, impacting jobs, technological advancements, and economic strength.

Offshoring of Production Facilities

If tariffs significantly raise production costs in the U.S., companies may opt to relocate manufacturing operations to countries with more favorable conditions. Possible scenarios include:

- Outsourcing: U.S. companies may shift chip production to contract manufacturers like TSMC (Taiwan) or Samsung Foundry (South Korea) instead of producing them domestically.

- Building new plants abroad: Instead of investing in U.S.-based factories, companies may prioritize new facilities in countries with lower tariffs and tax burdens.

This trend is already evident: Despite U.S. government support through initiatives like the CHIPS Act, Intel continues to expand its manufacturing capacity in Europe, while NVIDIA and AMD rely entirely on Asian foundries for their chip production.

If tariffs on imported components persist or intensify, this will further incentivize companies to shift production overseas, diminishing the U.S.’s role as a semiconductor manufacturing hub.

Retaliatory Measures from Other Countries

Trade wars are rarely one-sided—if the U.S. imposes tariffs on semiconductor components or finished products, other countries may respond with similar measures. Potential consequences include:

- The European Union could introduce counter-tariffs on U.S.-made chips, making it harder for companies like Intel, AMD, and Qualcomm to export to European markets.

- China, the largest semiconductor consumer, could restrict the export of rare earth metals or ban purchases from U.S. chipmakers.

- South Korea and Taiwan, as technological leaders, could tighten export regulations for essential semiconductor equipment and intellectual property, further complicating U.S. production capabilities.

Such retaliatory actions could disrupt the semiconductor supply chain even further, making domestic production in the U.S. even less viable.

Slower Innovation and Reduced Investment

Higher tariff costs and rising production expenses may lead to reduced investment in research and development (R&D)—a critical issue for a sector where technological progress determines success. Possible negative outcomes include:

- Lower R&D budgets for new chip architectures and process technologies, as companies redirect funds to offset tariff-related costs.

- Delays in adopting advanced manufacturing nodes—if companies cannot afford new equipment, transitions from 5nm to 3nm processes may be postponed, weakening the U.S. semiconductor industry’s technological edge.

- Struggles for semiconductor startups—new market entrants may face additional barriers due to higher costs for importing equipment and materials, limiting their ability to compete.

The U.S. semiconductor sector thrives on innovation and technological leadership, but tariff policies could artificially slow progress, ultimately weakening the nation’s position in the global tech race.

Dr. Viktor Kalm is a Senior Investment Analyst at Alpha Spread. He has over seven years of experience in corporate finance, specializing in financial modeling, business valuation, and strategic planning services. Previously, as a hedge fund manager, he focused on private equity management, consistently delivering positive returns to his clients.

Dr. Viktor Kalm is a Senior Investment Analyst at Alpha Spread. He has over seven years of experience in corporate finance, specializing in financial modeling, business valuation, and strategic planning services. Previously, as a hedge fund manager, he focused on private equity management, consistently delivering positive returns to his clients.

JNJ

JNJ

HD

HD

V

V

CAT

CAT

PG

PG

TXN

TXN

AAPL

AAPL

NVDA

NVDA

ADBE

ADBE

MSFT

MSFT

NVDA

NVDA

NVDA

NVDA

ASML

ASML

AAPL

AAPL

NVDA

NVDA

GOOGL

GOOGL

META

META

MSFT

MSFT

AMZN

AMZN

TSLA

TSLA

HCA

HCA

MU

MU

AAPL

AAPL

NVDA

NVDA

GOOGL

GOOGL

META

META

MSFT

MSFT

AMD

AMD

AMZN

AMZN

TSLA

TSLA

2330

2330

You don't have any saved screeners yet

You don't have any saved screeners yet