ALGLD

vs

D

DAX Index

ALGLD

vs

D

DAX Index

ALGLD

ALGLD

Over the past 12 months, ALGLD has underperformed DAX Index, delivering a return of -29% compared to the DAX Index's +19% growth.

Stocks Performance

ALGLD vs DAX Index

Performance Gap

ALGLD vs DAX Index

Performance By Year

ALGLD vs DAX Index

Compare the stock's returns with its benchmark index and competitors. Gain insights into its relative performance over time.

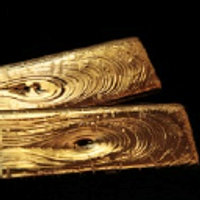

Gold by Gold SA

Glance View

Gold by Gold SA engages in trading, mining, and refining precious metals. The company is headquartered in Paris, Ile-De-France. The company went IPO on 2012-04-13. The Company‘s activities include Trading, Collection & Recycling and Refining & Recycling. The processed products are resold primarily to the jewelry industry. Trading includes buying gold in Latin America and selling gold in Europe. The Collection & Recycling division deals with purchasing and recycling precious metals from individuals as well as from businesses. The Refining and Recycling division collects the gold via their website and it is refined and resold. Silver, platinum and palladium are also refined. The firm also offers technical expertise services, financing services, and logistical services to miners. The company operates through two France-based subsidiaries: Aurfina Sarl and Bon Aloi Sas and one affiliate Jel Sarl.