Price is what you pay. Value is what you get.

– Warren Buffett

Value investing is a strategy that entails selecting stocks that appear to be trading for less than their actual value. Proponents of the strategy believe the market overreacts to both good and bad news, exposing potentially lucrative trades.

Compared to growth strategies, value strategies are often slower moving, requiring patience and discipline. That is, holding periods are typically longer.

If growth was the hare, value is the tortoise, and we all know how that ended.

Over the next few minutes, we’ll explore the merits of this old-school stock valuation strategy, held dearly by some of the most prominent traders on Wall Street.

Among other topics, we’ll dive into the following:

- The strategy’s historical performance.

- The rationale supporting value investing.

- How the strategy compares to growth investing.

Understanding Value Investing

All intelligent investing is value investing – acquiring more than you are paying for. You must value the business in order to value the stock.

– Charlie Munger

When we refer to value investing, we’re referring to the approach popularized by Benjamin Graham and Dodd in their 1934 book, “Security Analysis.” This analytical style aims to identify stocks with minimal permanent capital risk while maximizing the probability of attractive returns.

Conversely, Fama and French’s factor investing is a top-down model premised on market efficiency and the existence of risk factors that can explain stock return disparities. This approach holds that high book-to-market ratios imply a stock is undervalued. However, we don’t believe this is always the case, and it’s one of the criticisms leveled against the Fama and French approach. In fact, it’s often considered more of a screening tool, ignoring nuances of future potential earnings that pure value practitioners employ.

Ultimately, value investing, as envisioned by Graham, is an approach to identify company shares that are trading below their intrinsic value. It attempts to locate companies the market has undervalued and purchase shares with the expectation they will appreciate to their true value over time.

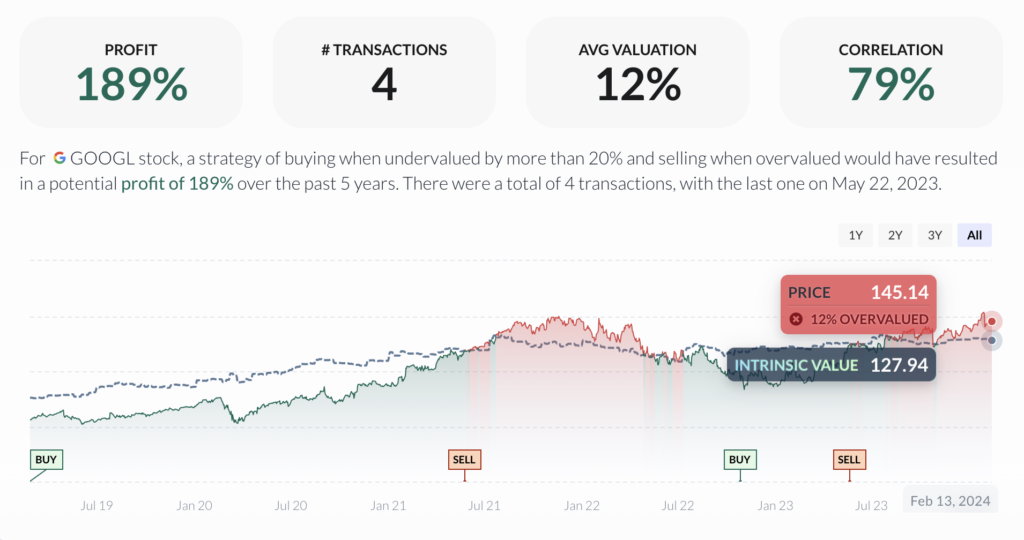

For example, look at the Alphabet Inc. (NASDAQ:GOOGL) chart above. If you purchased GOOGL when the platform identified it was trading at a 20% discount and sold it when it was flagged as overvalued, you would have returned 189% (CAGR 23.65%) in profit over the past five years.

Merits of Value Investing

Historical Performance

Historically, on years when value outperforms growth, the average premium is almost 15%. If we go back nearly a century to 1927, value stocks have outperformed growth counterparts by an average of 4.4% annually.

Margin of Safety

One of the concepts that underpin value investing is the margin of safety. This refers to the difference between a stock’s market price and its calculated intrinsic value. Buying shares at a significant discount to their intrinsic value provides a buffer against potential losses. This fact is particularly beneficial during heightened volatility or falling markets.

Focus on Fundamentals

Value investing encourages investors to focus on a comprehensive view of a company’s fundamentals rather than short-term market trends and speculation. By fundamentals, we mean a complete picture of a company’s revenue, profitability, assets, liabilities, dividends, cash flow, and growth prospects, among other business metrics.

While these metrics can offer insight individually, the true power of pure value investing comes from a holistic assessment of every part. Done correctly, a deep review of every facet of a business can help elicit a more precise intrinsic value.

This helps separate legitimate long-term investment “signal” from short-term “noise.” It helps keep value investors disciplined and focused, avoiding the pitfalls of market timing and emotional trading.

Reduced Volatility

Value stocks are typically less sensitive to market hype, leading to lower volatility than growth stocks. This can keep portfolios more stable and reduce the risk of substantial losses during bear markets.

Value Versus Growth

We’ve covered the merits of value investing, but how does it differ from a strategy focused on growth?

With growth investing, companies that show signs of above-average growth are targeted, even if their share prices are higher in relation to their current earnings or assets.

The last line is critical. Growth investors are attracted to companies expected to grow sales, earnings, or cash flow faster than the market average. You’ll often see this strategy employed in volatile sectors, like technology, where rapid advancement can take place.

Of course, a rapidly appreciating stock is tempting. It offers investors the potential for fast, outsized returns. However, it comes at a cost, like higher volatility and risk. And when growth stocks don’t hit highly anticipated future earnings… watch out; prices can rapidly dissolve.

As mentioned, growth has also underperformed value over the past century. While you might hear tales of a local doctor hitting it big when he purchased Google in the early days, many others likely lost their shirts (or scrubs) in IPOs that ultimately fizzled out.

And to top it off, growth stocks typically don’t pay dividends. Instead, these rapidly growing companies usually prefer to reinvest cash into growing the business.

This brings us back to Aesop’s Fable, “The Tortoise and the Hare.” Growth stocks often see rapid, short-term gains but aren’t necessarily as robust as the slower price appreciation witnessed among value stocks.

And like the tortoise, value has been shown to win over the long run.

Challenges and Considerations of Value Investing

Despite its merits, value investing is not without challenges. Identifying truly undervalued stocks requires significant research and analysis, and not all undervalued stocks recover to their intrinsic value.

Market inefficiencies can persist for a long time, longer than you may be able to wait.

However, for disciplined investors with patience and a long time horizon, a value focus can help deliver superior performance.

Value investing can also be challenging in specific markets. During prolonged bull runs, for example, growth stocks typically outshine their value counterparts. For value investors, it can be difficult to watch.

Conducting Fundamental Analysis

Fundamental analysis is the cornerstone of value investing. It involves examining a company’s financial statements to assess its financial health, competitiveness, and future earnings potential. This includes reviewing assets, liabilities, earnings, and future cash flows.

Again, it’s imperative to note that pure value investing demands an aggregate assessment of all parts of a company. It requires a comprehensive and rigorous analysis of a company’s fundamentals to determine its intrinsic value. Armed with this knowledge, value investors can invest in companies whose intrinsic value is significantly higher than their market price, with the expectation that the share price will rise. Conversely, they can avoid companies whose intrinsic value is substantially lower than their market price.

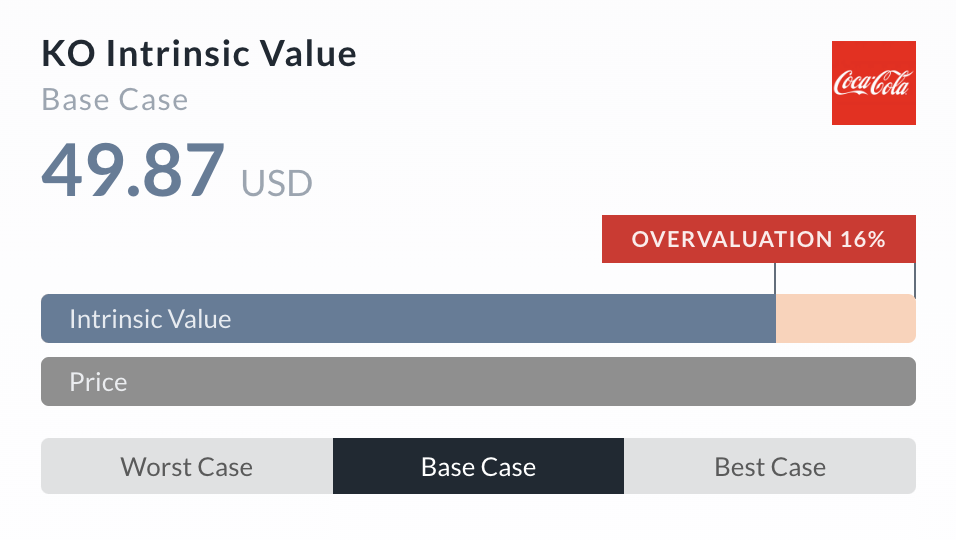

For example, looking at Coca-Cola Co. (NYSE:KO) on Alpha Spread, we are presented with an intrinsic of $49.87 based on a comprehensive assessment of the soft drink makers’ fundamentals.

Since Coca-Cola was trading at $59.35 at the time of the calculator, it implies the stock is overvalued by $9.48, or 16%. As a result, it’s expected that Coca-Cola shares will likely fall over time.

Critically, the pure form of value investing that we espouse, popularized by Graham, is based on the principle that in order to assess a stock’s worth, one needs to evaluate the underlying business from a fundamental perspective. The goal is to project the future cash flows that a company can distribute and to purchase the stock when its market price is substantially below the intrinsic value suggested by these flows.

A Stoic Strategy

Value investing offers a disciplined approach focusing on fundamental analysis, long-term prospects, and the pursuit of stocks trading below their intrinsic value. Its historical performance, emphasis on a margin of safety, and potential for stable returns make an attractive solution for many investors, including the Oracle of Omaha, Warren Buffett.

Despite this reality, value investing demands patience, thorough research, and a tolerance for periods of underperformance. Individuals must consider their unique financial situation, risk tolerance, and investment goals when determining if value investing aligns with their overall strategy.

The answer will be yes for many, but there are more hares out there than you imagine.

Jesse Oberoi

I’ve held the CFA charter since 2017.

With a career spanning over 15 years in the finance industry, I’ve been fortunate to amass a diverse set of experiences spanning multiple domains.

I’ve managed multi-billion dollar tactical asset allocation calls as a Portfolio Operations Manager.

I’ve been responsible for a group of flagship, multi-asset class funds exceeding $4B in AUM as a Product Manager.