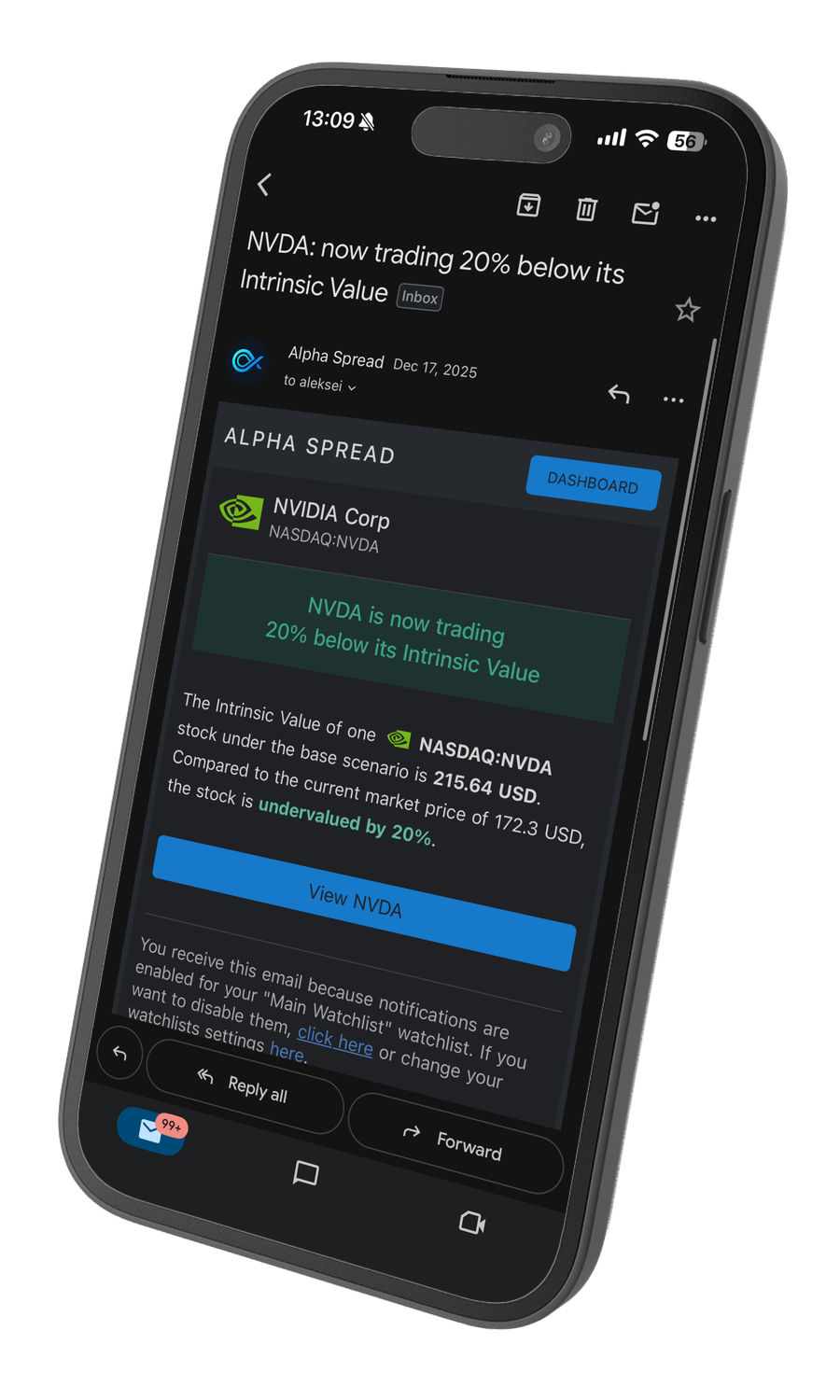

Valuation is only useful if it helps explain future outcomes. That's why we continuously run quality checks on our valuation signals across a broad universe of stocks and long history. Below is a plain-English explanation of the metrics we use, why they matter, and our latest global results.

At a high level, we test whether stocks that look undervalued by our models tend to deliver better forward returns than stocks that look overvalued.

To avoid "cherry-picking," we compute these metrics on a large sample and use robust statistics.

What it is: A rank correlation between our valuation signal and 12-month forward returns.

How to read it: undervalued ranks tend to outperform overvalued ranks. A positive correlation means the signal is directionally consistent across the cross-section (not just a few names).

What it is: The difference between the top 20% most undervalued and the bottom 20% most overvalued stocks, measured by their forward returns.

How to read it: This is an intuitive "portfolio-style" test: "What happens if you buy undervalued and avoid overvalued?"

What it is: The share of cases where the valuation signal gets the direction right (undervalued → positive forward return, overvalued → negative forward return).

How to read it: Above 50% indicates the signal is better than coin-flip directionally, even before position sizing or risk controls.

Note that a 100% hit rate is not realistic: an undervalued stock can become even more undervalued before it recovers (and vice versa).

| VIC (12M) | 0.3204 |

| Quintile Spread | 28.3% |

| Hit Rate | 65.1% |

Across a large sample, undervaluation identified by our models is associated with meaningfully better forward outcomes, the "undervalued vs overvalued" separation is large, and directional accuracy is strong.

No valuation model predicts every stock, markets are noisy. But a valuation signal is valuable if it is systematically informative across many stocks and many periods. These metrics are our way of holding the system accountable, and the latest results show strong, consistent evidence that the signal is real.